is stock trading taxable in malaysia

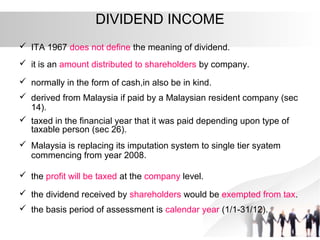

It is not taxable in Malaysia except for gains derived from the disposal of real property or on the sale. Dividend Yield Annual Dividend Current Stock Price x 100.

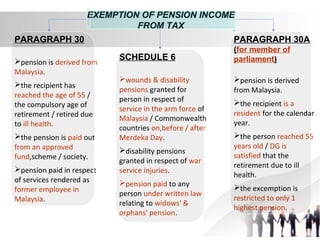

Taxation Principles Dividend Interest Rental Royalty And Other So

Depending on how often you trade shares and how the Inland Revenue Board Of Malaysia IRBM classifies you you might need to pay tax on the profits or gains youve made or you could be eligible for a tax exemption.

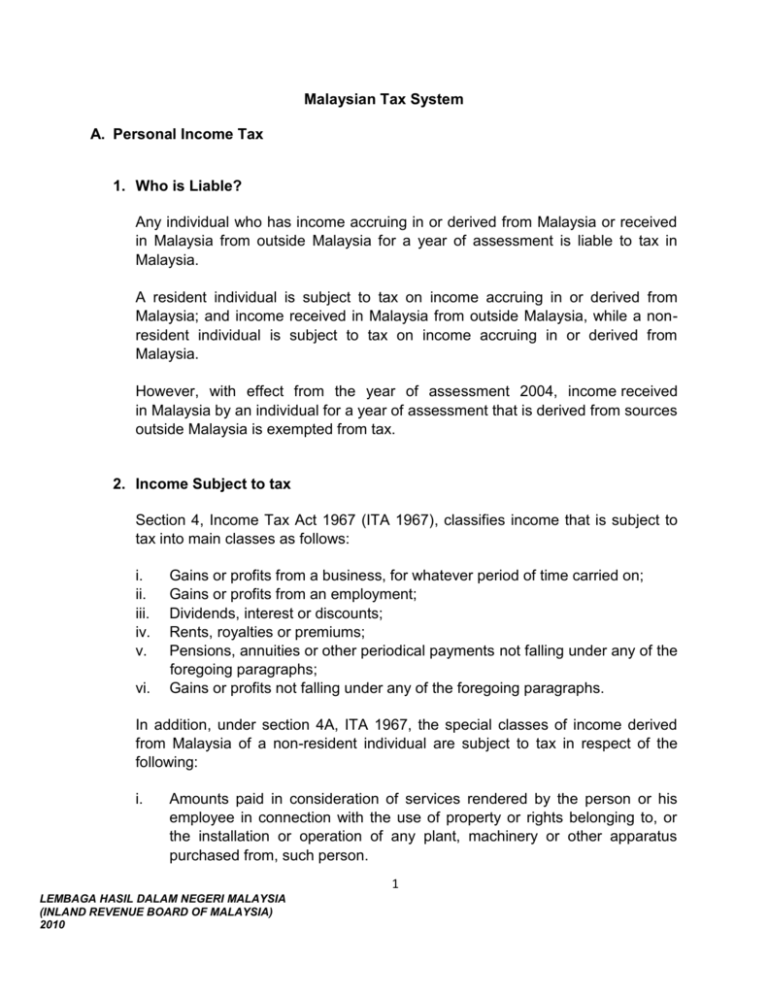

. Your capital assets are also not subject to this tax system. Generally income taxable under the Income Tax Act 1967 ITA 1967 is income derived from Malaysia such as business or employment income. Posted by Ayoyo 2019-03-17 0421 Report Abuse While there are no capital gains tax here has anyone declared trading.

The net profit gained from the share market is taxable if the transaction is done repeatedly. Is forex trading taxable in Malaysia 2020 price list price today is forex trading taxable in Malaysia 2020 price guide is forex trading taxable in Malaysia. Its tax time again which means a couple of things if you trade shares in Malaysia.

Capital gains on shares are not taxed. Forex income is taxable in Malaysia as income tax but Forex capital gains are exempt from tax. How to Invest in US Stock Market from Malaysia.

How the Capital Gains Tax Works. Individual retail investors in the stock market generally tend to invest in the stock market with the. Use a foreign broker.

Wisma THK 41 Jalan Molek 18 Taman Molek 81100 Johor Bahru. Malaysian investors should count themselves extremely lucky as capital gains from your stocks are not taxable. Any capital gains on shares are not subject to tax under the Malaysian Income Tax Act 1967 ITA.

In Malaysia only income is subject to tax. For tax purposes the value of stock in tradewhich is taken into account in determining the adjusted income is ascertained in accordance with section 35 of the ITA. Open a trading account in the country where the respective stocks originate from.

The difference between the cost value and the market value of the auto parts is treated as. The countrys main stock exchange formerly called the Kuala Lumpur Stock Exchange became the Bursa Malaysia Exchange in. Capital gains arising from stock trading activities including ESOS are also not liable for income tax payments in.

Are profits from stock trading taxable in Malaysia. However as one reader wrote in most people are of the view that capital gains. The value of the s.

KTP Audit Tax Advisory An approved audit firm and licensed tax firm operating under the KTP group. After that you should understand that all forex traders in. Whether youre a trader or investor this guide explains how much.

However if the activity of trading in shares is frequent enough the Malaysian. For instance if you want to invest in an American company. If you invest in forex trading be ready to remit income taxes except for forex capital gains exempted.

Any capital gains on. Yes it is. In Malaysia any sale made from your investments is not subject to the capital gains tax.

Trading Stocks in Malaysia. The Company is required to account for the auto parts withdrawn from its stock. Are Capital Gains or Dividends Taxable in Malaysia.

Capital gains on shares are not taxed. Best Blue Chip Stocks in.

Taxation Principles Dividend Interest Rental Royalty And Other So

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

Taxation Principles Dividend Interest Rental Royalty And Other So

Withdrawal Of Stock Tax Risks Crowe Malaysia Plt

Day Trading Taxes How Profits On Trading Are Taxed

The Complete Personal Income Tax Guide 2014 Infographic Tax Guide Income Tax Tax

Free Online Malaysia Corporate Income Tax Calculator For Ya 2020

Day Trading In Malaysia 2022 How To Start Markets Strategies

Day Trading In Malaysia 2022 How To Start Markets Strategies

Tax And Investments In Malaysia Crowe Malaysia Plt

Malaysia Income Tax Guide 2016 Ringgitplus Com

Capital Gains And Windfall Tax Pros And Cons Lexology

Esos What You Need To Declare When Filing Your Income Tax

Tax Considerations For Foreign Entities With Or Without Physical Presence In Malaysia Donovan Ho

Crowe Perspectives Badges Of Trade Crowe Malaysia Plt

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt